do you pay property taxes on a leased car in ct

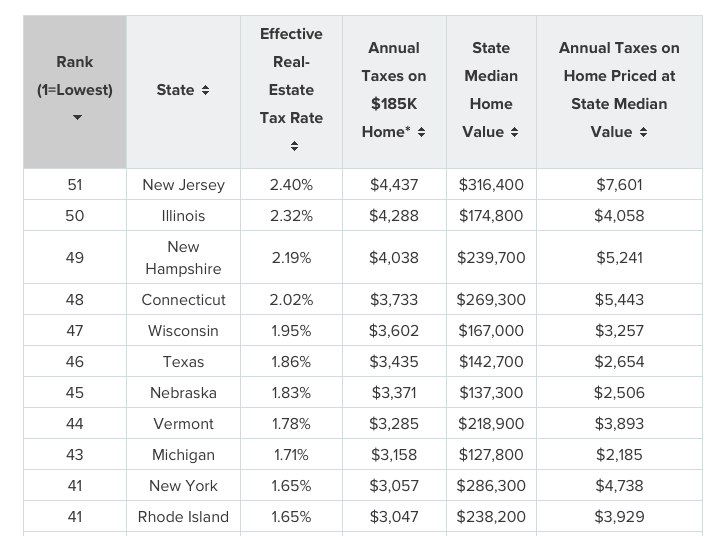

Many districts especially those formed by. Which U S States Charge Property Taxes For Cars Mansion Global For vehicles that are being rented or.

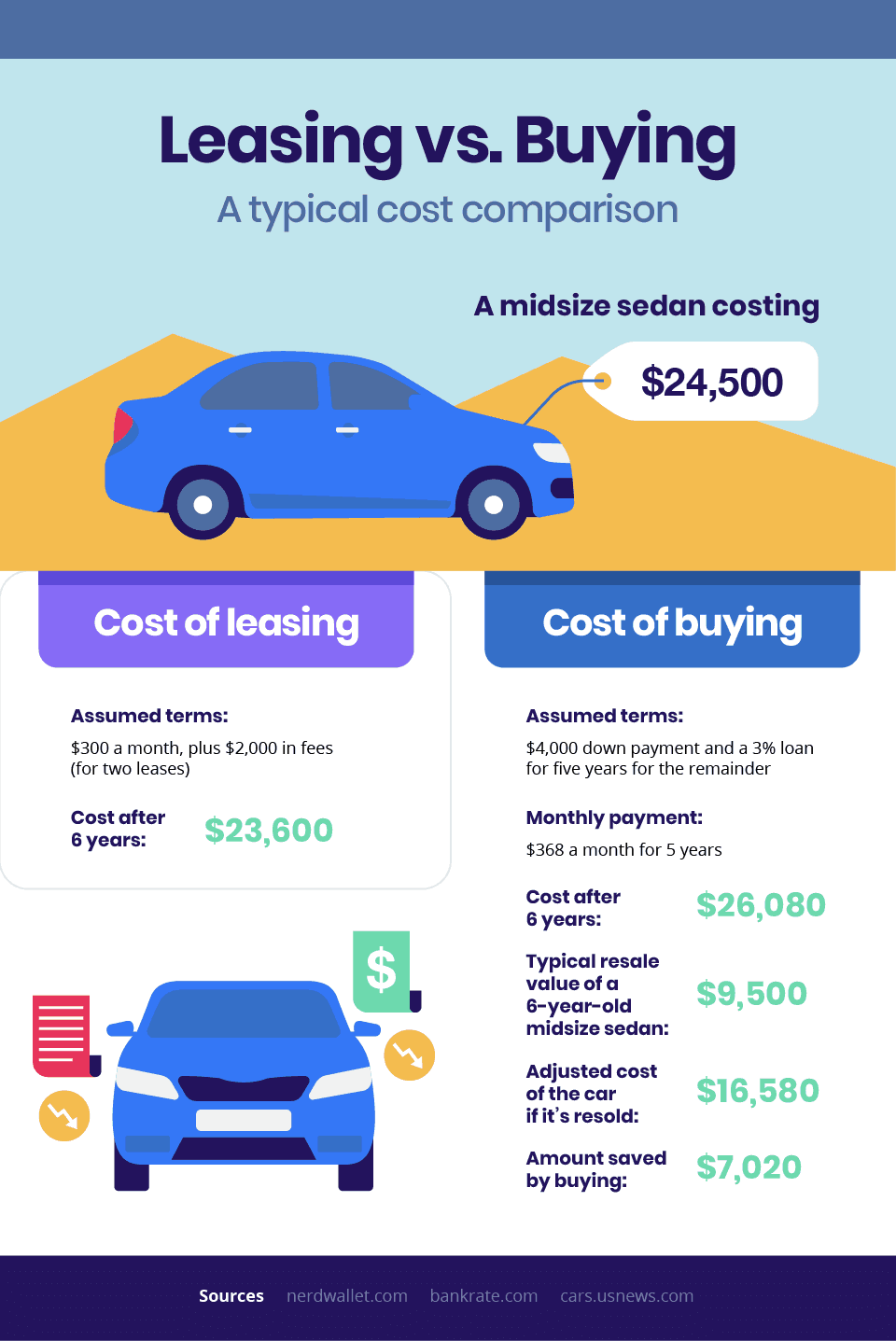

Leasing Vs Buying A Car Pros And Cons Travelers Insurance

When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle.

. Most leasing companies though pass on the taxes to lessees. In all cases the tax advisor charges the taxes to the dealer and the dealer pays. Furthermore sales tax will be added to each monthly lease payment.

However the bill is mailed directly to the leasing company since leased cars are registered in. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most frequently. They pay the personal property taxes on the vehicle unless otherwise stated in your lease contract.

When you lease a car the dealer still maintains ownership. In most states you are not required to pay sales tax on the purchase or sale of your vehicle. These vehicles can only carry.

11 Nov 6 2012. The amount of property taxes youll owe will depend on the state where you live and the value of. You pay personal property taxes on the vehicle unless otherwise stated in your lease.

Max_g may 23 2019 627pm 6. If the lease agreement states that you are responsible for these taxes you will receive an invoice from the. Joined Jul 16 2011.

Instead of sales tax a percentage of sales tax will be added to the monthly lease. All tax rules apply to leased vehicles. When you rent a car the dealer always retains ownership.

If you purchase a vehicle instead of lease it you are paying sales tax on the entire value of the vehicle sales tax in Connecticut is 635 or 775 for vehicles over 50000 and it is based. In most cases youll have to pay tax payments on your leased car each year that you have it. CONNECTICUT Connecticut car owners including leasing companies are liable for local property taxes.

Do you pay taxes on a leased car in ct. Cars trucks RVs boats etc. No tax is due on the sale or lease of vehicles which are delivered outside Connecticut by seller to purchaser and are used within the borders of Connecticut.

Some states like mine have a personal property tax on vehicles. Tax Collector Do I pay taxes on my leased vehicle.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

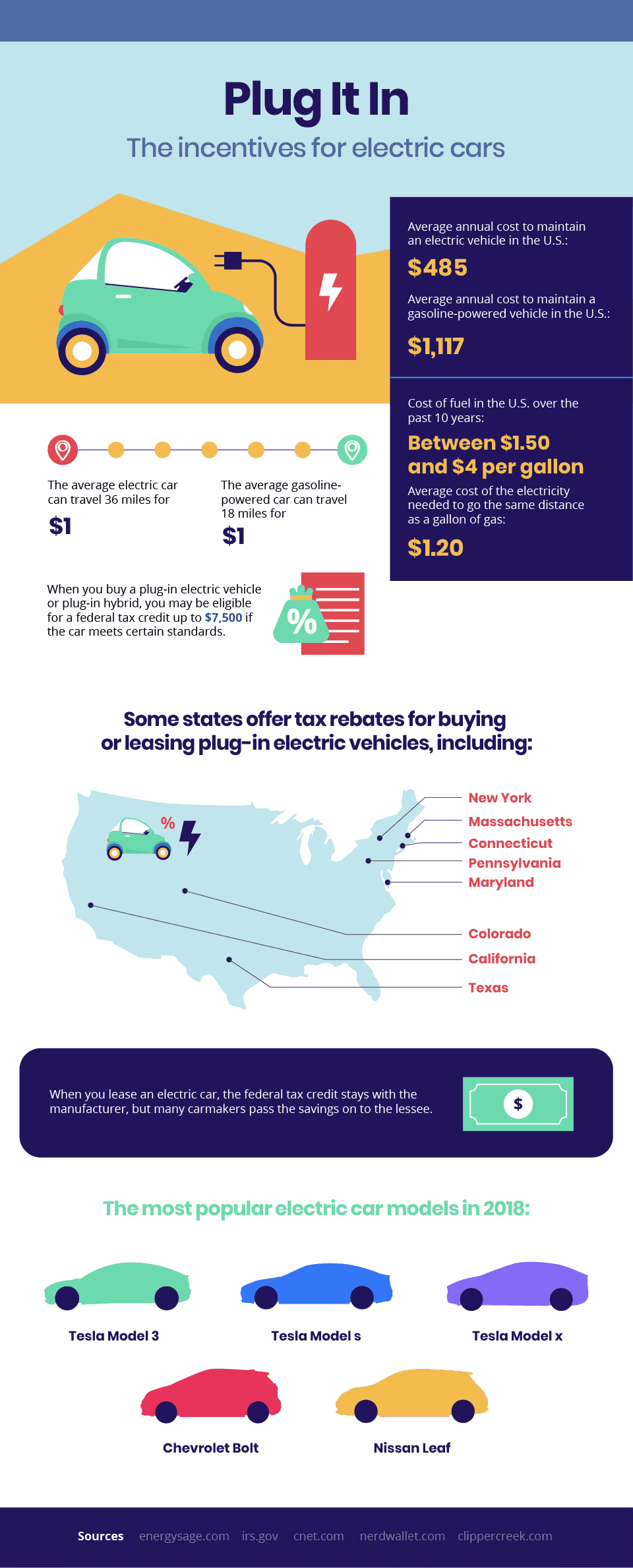

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Leasing A Car And Moving To Another State What To Know And What To Do

Leasing A Car And Moving To Another State What To Know And What To Do

Is It Better To Buy Or Lease A Car Taxact Blog

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

Connecticut S Sales Tax On Cars

A Complete Guide On Car Sales Tax By State Shift

How Do People Pay For Their Luxury Cars Capital One Auto Navigator

How To Buy A Leased Car 15 Steps With Pictures Wikihow

Nj Car Sales Tax Everything You Need To Know

Insuring A Leased Vehicle Bankrate

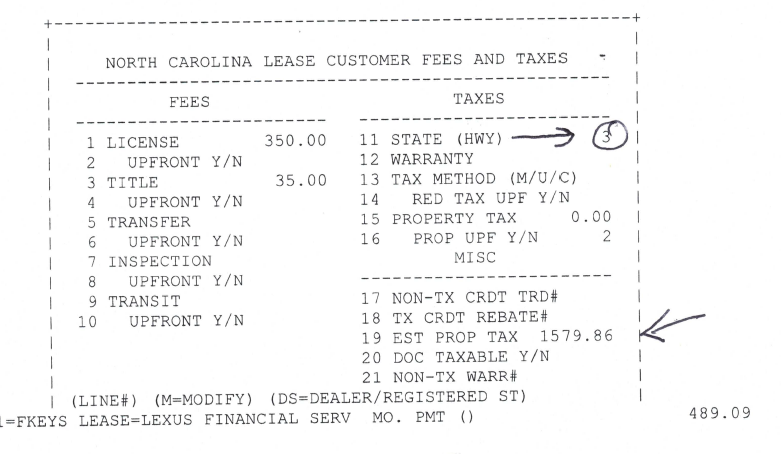

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Is It Better To Buy Or Lease A Car Taxact Blog

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct